Top 10 Most Popular Metal Materials in 2024 and Their Applications

In 2024, the global market for metal materials is projected to experience substantial growth, driven by advancements in various industries such as aerospace, automotive, electronics, and medical sectors. Metal materials have long been the backbone of industrial development, and their importance is only growing as new technologies and applications emerge. Each year, the demand for certain types of metals rises, reflecting shifts in industrial needs, technological innovations, and consumer preferences.

According to a report by Grand View Research, the stainless steel market alone is expected to see a significant increase due to its widespread use in construction, food processing, and medical equipment. Similarly, aluminum alloys continue to gain traction in the automotive and aerospace industries because of their lightweight properties, which are crucial for fuel efficiency and performance. As industries push for more sustainable, durable, and cost-effective materials, it is essential to understand which metals will lead the market in 2024 and what factors are influencing their popularity.

This article will explore the top ten most popular metal materials expected to dominate the market in 2024. We will delve into the unique properties of each metal, their applications across various industries, and the key trends driving their demand. Backed by data from leading market research firms like Statista و Markets and Markets, this comprehensive overview aims to provide valuable insights for manufacturers, engineers, and industry professionals looking to stay ahead of the curve in material selection and application.

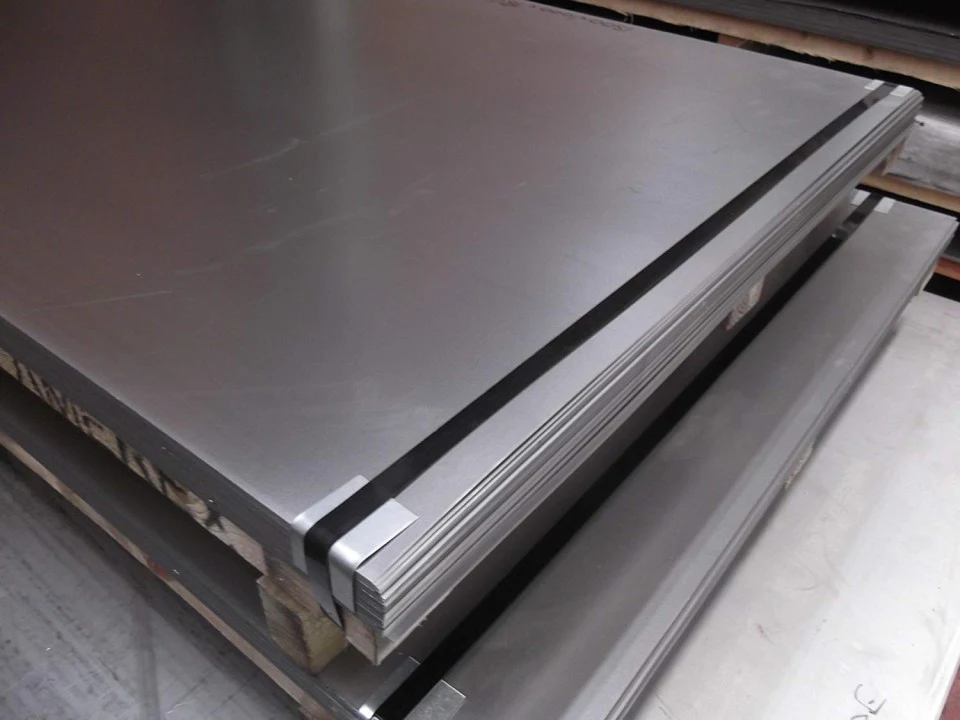

1. Stainless Steel

سtainless فُولاَذ continues to rank among the top popular metal materials in 2024 due to its exceptional properties, including corrosion resistance, durability, and versatility.

In 2023, the global stainless steel market was valued at USD 117.63 billion and is projected to grow at a compound annual growth rate (CAGR) of 6.7% from 2024 to 2030, reaching approximately USD 197.29 billion by the end of the forecast period (Grand View Research). This growth is largely driven by significant investments in infrastructure and residential housing, as well as the material’s extensive use across industries such as building & construction, automotive, transportation, and process industries. For example, in the United States, the building & construction segment alone accounted for 11.3% of the stainless steel market demand in 2023, reflecting its importance in structural applications where both strength and aesthetic appeal are required.

The Asia Pacific region led the market with a revenue share of over 68% in 2023, supported by rapid expansion in the defense, machinery, automotive, and shipbuilding industries in countries like China, India, South Korea, and Japan. Within the market, the 300 series stainless steel, particularly Grades 303 and 304, continues to dominate, holding over 59% of the market share due to its superior corrosion resistance and versatility in applications ranging from dairy equipment to aerospace components. Meanwhile, the duplex stainless steel segment is expected to grow at the highest CAGR of 8.5%, driven by its high strength and low weight, which are ideal for use in pharmaceutical, oil & gas, and chemical industries.

2. Aluminum Alloys

الألومنيوم سبائك continue to be a top choice in 2024, driven by their lightweight, high strength, and excellent corrosion resistance. According to Fortune Business Insights, the global aluminum alloys market size was valued at USD 85.77 billion in 2021 and is expected to reach USD 131.97 billion by 2029, growing at a compound annual growth rate (CAGR) of 5.7% during the forecast period. This growth is primarily attributed to the increasing demand in sectors such as automotive, aerospace, construction, and consumer electronics, where the focus is on reducing weight to improve efficiency and performance.

In the automotive industry, aluminum alloys are extensively used to manufacture lightweight vehicle bodies and engine components, which help in meeting strict fuel efficiency and emission standards. Similarly, in the aerospace sector, aluminum alloys are crucial for the production of aircraft fuselage, wings, and other critical components due to their ability to withstand high stress while being relatively light. In 2021, the Asia Pacific region dominated the aluminum alloys market, accounting for a significant share of the global revenue. This dominance is supported by rapid industrialization and growth in the automotive and construction industries in countries like China, India, and Japan. As industries worldwide continue to seek sustainable and efficient materials, aluminum alloys are well-positioned to remain essential across various high-growth sectors.

3. Titanium Alloys

سبائك التيتانيوم stand out in 2024 as a crucial material for industries that demand a balance of strength, lightweight properties, and resistance to extreme conditions. Unlike other metal materials, titanium alloys are uniquely suited for high-performance environments, from the vacuum of space to the human body. This versatility has led to their widespread adoption in the aerospace, medical, and energy sectors, where traditional metals often fall short.

One of the key drivers of titanium alloy demand is its use in the aerospace industry for jet engines, aircraft frames, and spacecraft components. For instance, companies like VSMPO-AVISMA Corporation (VSMPO-AVISMA), the world’s largest titanium producer, supply aerospace giants like Boeing and Airbus with high-quality titanium for critical parts. These components benefit from titanium’s ability to withstand high temperatures and stresses while contributing to overall weight reduction—an essential factor in enhancing fuel efficiency.

Beyond aerospace, the medical sector relies heavily on titanium alloys for orthopedic implants and dental prosthetics. Its biocompatibility and non-reactive nature make it ideal for long-term implantation in the human body, minimizing the risk of rejection or adverse reactions. ATI Inc. (ATI Inc.), a leader in advanced specialty materials, is known for its development of titanium alloys that meet the stringent needs of medical device manufacturers. Their alloys are used in everything from spinal implants to heart valves, showcasing their versatility.

Additionally, titanium’s role in the energy sector is growing, particularly in offshore drilling and power generation. The metal’s resistance to corrosion and extreme temperatures makes it ideal for use in deep-sea environments and nuclear reactors. Companies like Timet (Timet) and Baoji Titanium Industry Co., Ltd. (Baoji Titanium) are at the forefront of developing alloys tailored to these challenging conditions, helping to extend the lifespan of critical infrastructure.

As global industries continue to innovate and push the boundaries of performance and sustainability, titanium alloys are not just a choice but a necessity for modern engineering challenges. Their ability to operate where other metals cannot will only drive further growth and technological advancement.

4. Nickel Alloys

سبائك النيكل are becoming increasingly important due to their exceptional strength, heat resistance, and corrosion resistance, as well as their ability to perform in extreme environments. Alloys such as Inconel, Monel, and Hastelloy exemplify these properties, making them the top choice in industries that require high reliability and durability. The global nickel alloys market is expected to grow at a compound annual growth rate (CAGR) of 4.8% from 2023, reaching USD 18.03 billion by 2028, mainly driven by the rising demand for high-performance applications in aerospace, energy, and chemical processing sectors (Grand View Research).

In aerospace, they are critical for manufacturing jet engines and turbine components that must operate under high temperatures. Compared to other metals, nickel alloys offer superior thermal stability, high-temperature strength, and resistance to oxidation, which significantly extends the lifespan and efficiency of aerospace components. Leading companies like ATI Inc. (ATI) and Special Metals Corporation (Special Metals) are major suppliers of these materials. In the oil and gas sector, alloys like Inconel are highly valued for their corrosion resistance in extreme environments such as deep-sea drilling.

5. Copper and Copper Alloys

نحاس and its alloys, like brass (copper-zinc) and bronze (copper-tin), are vital for industries that require materials with excellent electrical and thermal conductivity, corrosion resistance, and formability. Copper alloys are indispensable in electronics, automotive, and construction sectors, where they are used for wiring, connectors, and architectural details. Copper’s superior conductivity and malleability make it the ideal choice for applications such as electrical motors, transformers, and heat exchangers, where efficiency and durability are crucial.

Alloys such as C11000 (electrolytic tough pitch copper) and C26000 (cartridge brass) are well-known for their high electrical conductivity and ease of fabrication. Leading companies like Aurubis AG and KME Group provide these materials to power generation and automotive manufacturers worldwide, enabling advancements in electric vehicles (EVs) and renewable energy systems. According to Statista, global copper consumption is expected to exceed 25 million metric tons by 2025, driven by the increasing demand for electric mobility and infrastructure development.

6. Magnesium Alloys

Magnesium alloys are becoming key materials in 2024 for their lightweight and high-strength properties, which are essential for automotive, aerospace, and electronics industries. Being 75% lighter than steel and 33% lighter than aluminum, alloys like AZ91D and WE43 are favored for reducing vehicle weight, boosting fuel efficiency, and enhancing overall performance. This has driven their use in automotive components, aircraft structures, and consumer electronics. Companies such as Magnesium Elektron and Norsk Hydro are pioneering innovative alloy compositions for engine blocks, gearboxes, and helicopter transmissions.

The global magnesium alloy market, valued at USD 1.3 billion in 2022, is expected to grow at a CAGR of 7.4% from 2023 to 2028, propelled by the rising demand for lightweight materials in electric vehicles and energy-efficient technologies (Fortune Business Insights). As industries push towards more sustainable solutions and strive to meet stricter emission standards, magnesium alloys are set to play a crucial role in advancing greener manufacturing and innovative product design.

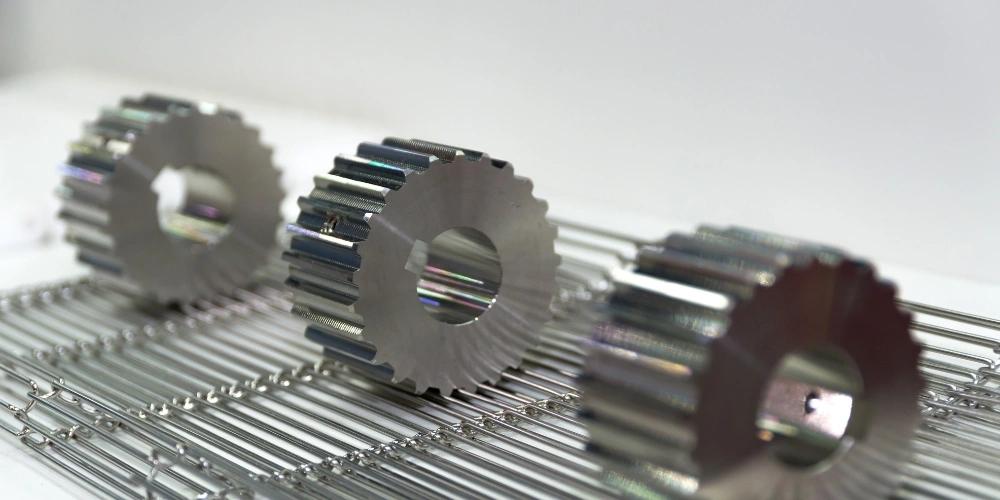

7. Superalloys

Superalloys are a class of high-performance alloys specifically engineered to withstand extreme temperatures, high stress, and oxidizing environments. Unlike standard nickel alloys, superalloys are designed with a combination of nickel, cobalt, or iron as their base, along with other elements like chromium, molybdenum, and titanium to enhance their properties. This makes them invaluable in the aerospace and power generation industries, especially for components like turbine blades, combustion chambers, and exhaust systems that must endure intense heat and mechanical loads.

Materials like Inconel 718 (a nickel-based superalloy) and Rene 41 (a nickel-chromium alloy) are renowned for their creep resistance and surface stability at temperatures over 700°C. Leading manufacturers such as GE Aviation and Pratt & Whitney rely heavily on these superalloys for their next-generation jet engines and space propulsion systems. According to Precedence Research, the superalloy market is set to grow at a CAGR of 6.8% from 2024 to 2032, fueled by the demand for fuel-efficient aircraft and clean energy solutions.

8. Carbon Steel

Carbon steel is a fundamental material in construction and machinery manufacturing due to its strength, cost-effectiveness, and versatility. Unlike specialty alloys, carbon steel comes in various grades, such as AISI 1018 (mild steel) and AISI 1045 (medium carbon steel), each offering a different balance of machinability and durability. These properties make carbon steel an excellent choice for structural components, automotive parts, and tooling applications.

Major producers like ArcelorMittal and Nippon Steel Corporation supply vast quantities of carbon steel globally, supporting infrastructure projects and industrial manufacturing. In 2021, global carbon steel production reached 1.86 billion metric tons, with China alone contributing over 50% of the total output (Allied Market Research). As global infrastructure projects expand, the demand for carbon steel is expected to remain strong.

9. Tungsten Alloys

Zirconium alloys, such as Zircaloy-2 and Zircaloy-4, play a crucial role in the nuclear energy sector thanks to their minimal neutron absorption and exceptional corrosion resistance. These properties make zirconium alloys well-suited to withstand the harsh conditions inside nuclear reactors, where they are primarily used in fuel rod cladding and other critical reactor components.

Leading companies like Westinghouse Electric Company and ATI Metals specialize in delivering advanced zirconium alloy solutions, which are pivotal for ensuring both the safety and efficiency of nuclear reactors. As the world increasingly turns to clean energy solutions, the significance of nuclear power within the global energy landscape is expected to grow. This shift is anticipated to drive a more than 20% increase in the global nuclear reactor fleet by 2040, thereby boosting the demand for zirconium alloys considerably, according to industry forecasts from Mordor Intelligence.

10. Zirconium Alloys

Zirconium alloys are becoming increasingly important in 2024, particularly in the nuclear energy sector, due to their low neutron absorption, high corrosion resistance, and robust performance under extreme conditions. Alloys like Zircaloy-2 and Zircaloy-4 are specifically designed for use in nuclear reactors, where they serve as fuel cladding—an essential barrier that prevents radioactive material from escaping. These alloys excel in high-radiation and corrosive environments, making them indispensable for maintaining reactor safety and efficiency over long periods.

With the global push for cleaner energy, the demand for zirconium alloys is set to rise significantly. The World Nuclear Association projects that the number of nuclear reactors worldwide will grow by over 20% by 2040, driven by new investments in countries like China, India, and the United States. Leading companies, such as Westinghouse Electric Company and ATI Metals, are at the forefront of developing advanced zirconium alloys to meet the stringent safety standards of next-generation reactors. As nuclear power gains momentum as a reliable, low-carbon energy source, zirconium alloys will play a vital role in supporting the industry’s evolution toward more sustainable energy solutions.

خاتمة

In 2024, the demand for metal materials like stainless steel, aluminum, titanium, nickel, copper, magnesium, superalloys, carbon steel, tungsten, and zirconium will continue to rise as industries like aerospace, automotive, electronics, and energy seek materials that offer the best balance of strength, durability, lightweight properties, and corrosion resistance. Understanding these trends and the factors driving them is essential for businesses looking to innovate and stay competitive in a rapidly evolving market.